Official WeChat

Construction Materials Industry Prosperity Index (MPI) for December 2024 - Construction Materials Industry Operation Remained Stable in December

I. Construction Materials Industry Prosperity Index for December

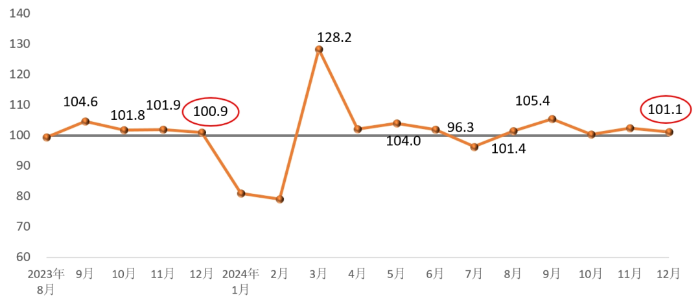

In December 2024, the Construction Materials Industry Prosperity Index (MPI) stood at 101.1 points, 1.3 points lower than that of November, and 0.2 points higher than that of the same month of the last year In December, the index was 101.1 points, 1.3 points lower than in November, and 0.2 points higher than in the same month of the previous year.

On the supply side, the price index and production index for the construction materials industry were both above the critical point in December. Among them, the building materials industry price index 100.1 points, 1.3 points lower than last month; building materials industry production index 101.0 points, the same as last month. Overall, the production of building materials products is stable, prices continue to stabilize.

Demand side, building materials investment demand index, industrial consumption index, international trade index are higher than the critical point. Among them, building materials investment demand index 101.0 points, down 1.5 points from the previous month, the construction market demand growth slowed down; building materials products industrial consumption index 100.8 points, down 0.6 points from the previous month, building materials industry chain upstream and downstream of the relevant manufacturing industry demand slowed down; building materials international trade index 104.4 points, down 2.1 points from the previous month, building materials commodities export trade to maintain growth, the rate of increase fell. Overall, in December, the demand for building materials market continued to reply to the trend, the industry operation remains stable.

II. Analysis of MPI influencing factors and early warning

Production of construction materials is stable. The production indexes of eight sub-industries, including concrete and cement products, wall materials, waterproof materials, lime gypsum, clay and sand mining, construction stone, construction technical glass, mineral fibers and composites, were in the boom zone. Wall materials, lightweight building materials, clay and gravel mining, construction stone, non-metallic minerals and other industry production index than the previous month to varying degrees of recovery. Ex-factory prices of building materials fluctuated steadily. in December, in the building materials sub-industry, wall materials, lightweight building materials, thermal insulation materials, clay and gravel mining, construction technology glass, non-metallic minerals and other 6 industry product prices rose, the number of price increases in the industry than the previous month decreased by 4, the other industries declined slightly. Building materials product prices in general continued to stabilize trend.

Industry operating environment is expected to show positive changes. Since the fourth quarter, building materials enterprises with coal, natural gas prices steady decline, high fluctuations in fuel oil prices, this winter and next spring building materials production with fuel prices will remain generally stable, supply is loose. National macro-control efforts to increase, with the relevant regulatory measures to the ground, the building materials industry market demand is expected to stabilize, but geopolitical changes, exchange rate fluctuations will further increase the uncertainty of building materials commodity trade. Overall, the relationship between supply and demand in the building materials industry is difficult to change in the short term, and it is still necessary to actively promote the adjustment of the repair of supply and demand, to reduce the perturbation of the expected changes in support of the industry to run back.